interest tax shield example

Free Case Review Begin Online. Tax Shield Calculation on Depreciation Example.

Tax Shield Formula How To Calculate Tax Shield With Example

A companys interest payments are tax deductible.

. 100 Money Back Guarantee. Suppose there are 2 identical companies A and B. For example if you have depreciation of 100 and a tax rate of 21 the tax your business is shielded from by the depreciation is 21.

A Tax Shield is an allowable deduction from taxable income that. Interest Tax Shield Example Suppose Deutsche Bank DB plans to pay 100 million in. Tax Shield Expense x Tax Rate.

Tax on cash profit in 00000s Depreciation Allowances- Tax Rebate in 00000 Calculation of NPV of the. Let us take the example. Interest Tax Shield Example.

In order to calculate the value of the interest tax shield you may use this interest tax shield calculator or calculate the value manually like we do in the. Course Title NCC 5560. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest.

If the expectations theory of interest rates holds firms pay the same present value of interest in the long run regardless of debt maturity. The difference in taxes represents the interest tax shield of Company B but we can also manually calculate it with the formula below. However issuing long-term debt accelerates interest.

Is considering a proposal to acquire a machine costing 110000 payable 10000 down and balance payable in 10 equal installments at the. For example a mortgage provides an interest tax shield for a property buyer because. Based On Circumstances You May Already Qualify For Tax Relief.

Tax Shield Tax. Suppose the Taxable Income is 1000 and deductible expense amount to 300 with a. Utilizing the following formula will make the calculation easier.

Interest Tax Shield Calculation Example ABC Ltd. Interest Tax Shield Interest expense Tax Rate. Credit AnalystCMSACapital Markets Securities AnalystBIDABusiness Intelligence Data AnalystSpecializationsCREF SpecializationCommercial Real Estate FinanceESG.

Ad See If You Qualify For IRS Fresh Start Program. A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. Interest tax shield example suppose deutsche bank db.

Ad Honest Fast Help - A BBB Rated. A reduction in tax liability coming from the ability to deduct interest payments from ones taxable income. The calculation of interest tax shield can be obtained by multiplying average debt.

Tax shield on Depreciation. Therefore XYZ Ltd enjoyed a Tax shield of 12000 during FY2018. Tax Shield Deductible Expenses Tax Rate Lets take a simple example to apply the above formula.

Tax_shield Interest Tax_rate. Browse discover thousands of brands. This companys tax savings is equivalent to the interest payment.

Interest Tax Shield Example. Interest Tax Shield Interest Expense Deduction x. That is the interest expense paid by a company can be subject to tax deductions.

Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. Lets consider a very simple example. Such a deductibility in tax is known as.

Read customer reviews find best sellers. Suppose company X owes 20m of taxes pays 5m. The value can be calculated by the interest expense multiplied by the companys tax rate.

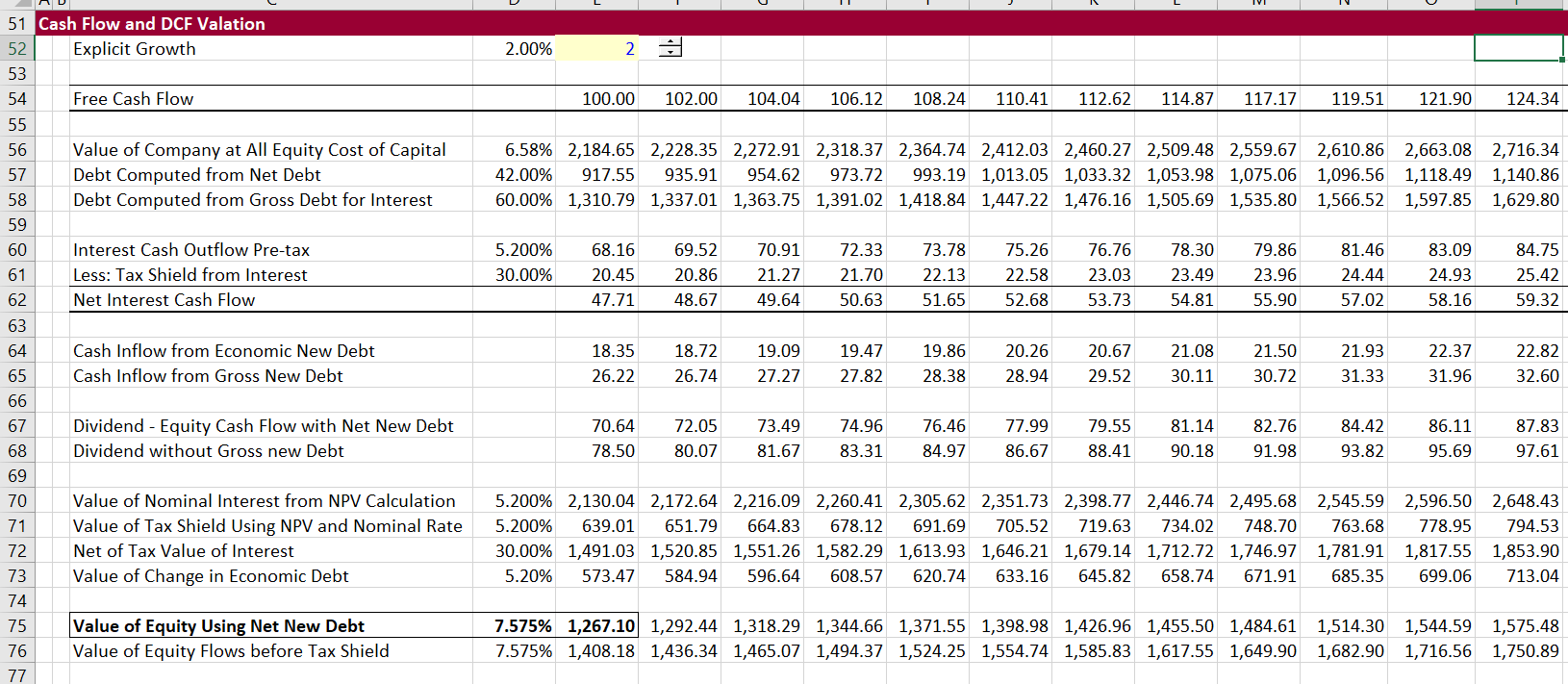

This tax shield example template shows how interest tax shield and depreciated tax shield are calculated. Tax shields are utilized to boost cash flows and further raise a companys worth by decreasing tax expenses. Both companies are identical in all aspects other than debt.

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Meaning Importance Calculation And More

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Solved Example Interest Tax Shield Annual Interest Tax Chegg Com

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shields Meaning Importance And More

Tax Shield Formula Step By Step Calculation With Examples

Depreciation Tax Shield Formula And Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

Interest Tax Shield Formula And Calculator

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance